- Chapter One - An Incorporated Village

- Chapter Two - Prelude to School

- Chapter Three - A Church Is Built

- Chapter Four - I Meet Sister Lucida

- Chapter Five - The Raleighs

- Chapter Six - Sister Emma

- Chapter Seven - Patriotism and Sister Florentia

- Chapter Eight - Fifth Grade Turning Points

- Chapter Nine - Seven, Eight and You're Out

- Chapter Ten - Epilogue

Poll Tax: 20th Century Constitutional Amendment

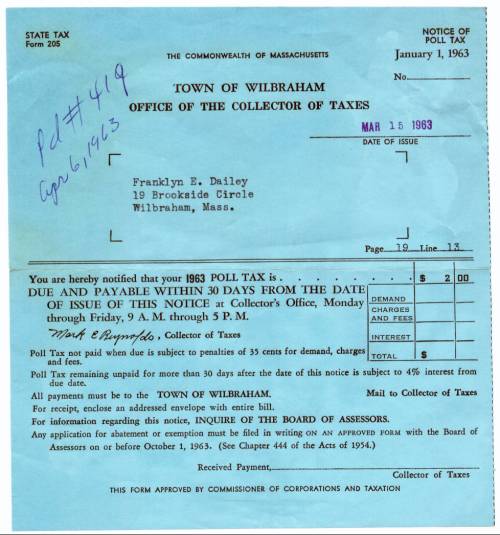

In 1963, the Right to Vote still cost $2.00 in Massachusetts; actual receipt shown here.

Voting Rights, Civil Rights Acts

Copyright 2013 Franklyn E. Dailey Jr. (Some of this moves the action into the 21st Century)

First, a very short review of three 19th Century Amendments, as background to lead us to an important Amendment in the 20th Century.

The 15th Amendment to the U.S. Constitution was third in a series of three Amendments, the 13th and 14th preceding it, that were ratified as an outgrowth of the Civil War. The 15th Amendment prohibited 'each government in the United States' from denying a citizen the right to vote based on that citizen's "race, color, or previous condition of servitude." So, the States could still refuse voting rights for citizens as long as they did not do it for the reasons proscribed by the 15th Amendment. And they did.

Now let's take a look at abolishing the poll tax, the 24th Amendment, and just one of its curious aspects. My wife, Peggy and I, both of voting age at marriage in 1944, led a military family's life, and had voted whenever we could establish residence. In the first long-stay (45-year) residence of our marriage, I met face-to-Voter-Registrar over the matter of a poll tax. It was 1963. And, guess where?

Georgia failed to ratify the Women's Suffrage (right to vote) Amendment in 1919. Georgia then had to let ladies vote when Tennessee became the 36th State to ratify in 1920. Georgia did 'ratify' the Amendment in 1970. Not entirely surprising that a southern state might be a little slow on socio-political progress. Safely among the 36 States that did put ratification of women's right to vote over the top was progressive Massachusetts.

I arrived in Massachusetts in January 1962, needing a home, the 17th for our growing family, in what had been a wartime journey fairly common for those who reached military service age in the late 1930s or early 1940s. By June of 1962 I owned a home in Wilbraham, Massachusetts, a suburb of the city of Springfield, in the western part of the State. Peggy and the five children who had stayed behind with her in San Diego, California, arrived in Massachusetts in early June. We moved into our new 'spec' home in June 1962. The early autumn saw us getting children into school, and adjusting to family living in a new neighborhood, with local customs and traditions.

By 1963 we were ready to exercise our voting rights. And so, in March, I went to the Town Hall of Wilbraham, Massachusetts, to register to vote. Whoa!

"First, Mr. Dailey, there is the little matter of the poll tax."

"What? In this bastion of pilgrim democracy, is a town official telling me there is such a thing as a poll tax?"

Peggy and I had voted years earlier in a number of states, including Virginia, the heart of the Confederacy.! (Virginia, it needs to be noted, had imposed a special federal registration requirement, not a poll tax, but an impediment to voters who did not pay the poll tax in the state's elections.)

Poll Tax Bill dtd March 15, 1963, Town of Wilbraham, Massachusetts; receipted April 6, 1963

Citizen rights of African-Americans, long denied, had been confirmed in three Amendments that were an outgrowth of the Civil War. The 15th Amendment was to have righted the denial of voting. But these citizens had still been kept from exercise of voting rights on into another century. One process by which they continued to be denied voting rights was lack of money with which to pay poll taxes.

Massachusetts was due acknowledgment of the sacrifices of her men who had fought and perished on the Union side in the Civil War. I had to conclude that Massachusetts took advantage of the poll tax simply to increase its revenues. Still, shame, that an ugly tax was needed to bring in revenues that could have been gained from some tax that did not have the shame of 'poll tax.'

It took the 24th Amendment, ratified in 1964, to abolish the odorous poll tax, even for the Commonwealth of Massachusetts.

It seems now, in the year 2010, almost beyond belief that our nation still needed aVoting Rights Act of 1965!